Saved Bookmarks

| 1. |

S,T,U and V were partners ina firm sharingprofitsin theratio of 4:3:2:1.On 1st April, 2016, their Balance Sheetwas as follows: From theabovedate partners decided to share the future profits in 3: 1:2:4 ratio. Forthispurposethegoodwillof the firm was valued at ₹90,000. This partners also agreed forthe following: (i) Theclaimfor workmencompensation has been estimedat ₹70,000. (ii) To adjustthe capitals of thepartners according to new profit-sharing ratio byopeningPartners'CurrentAccounts. PrepareRevalutionsAccount,Partners' Capital Accounts andthe Balance sheet of the reconsituted firm. |

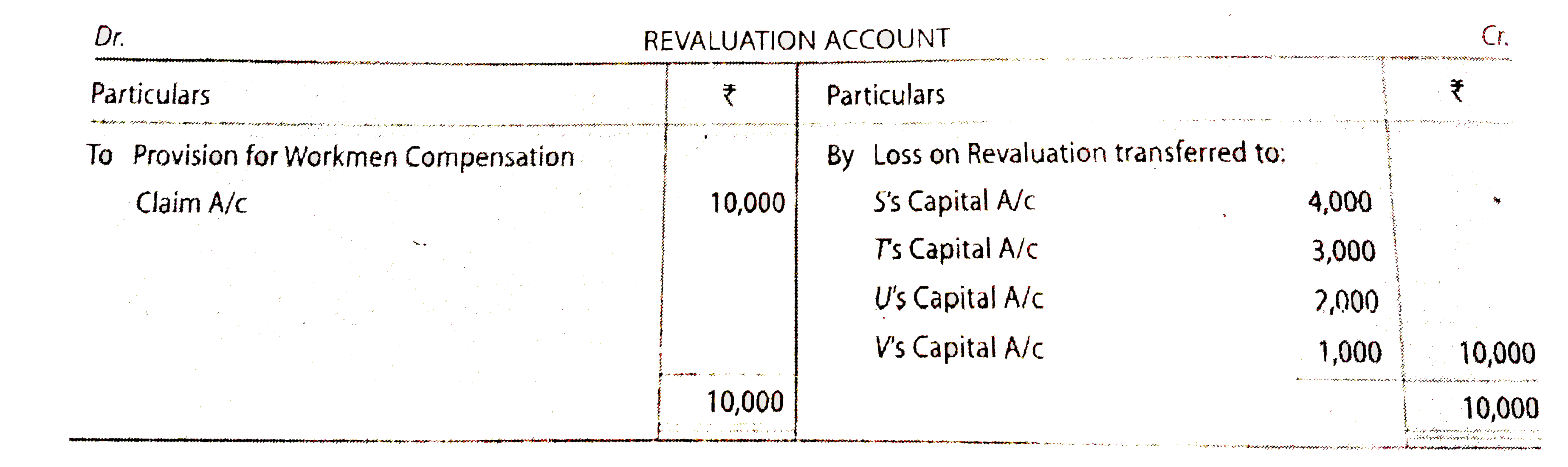

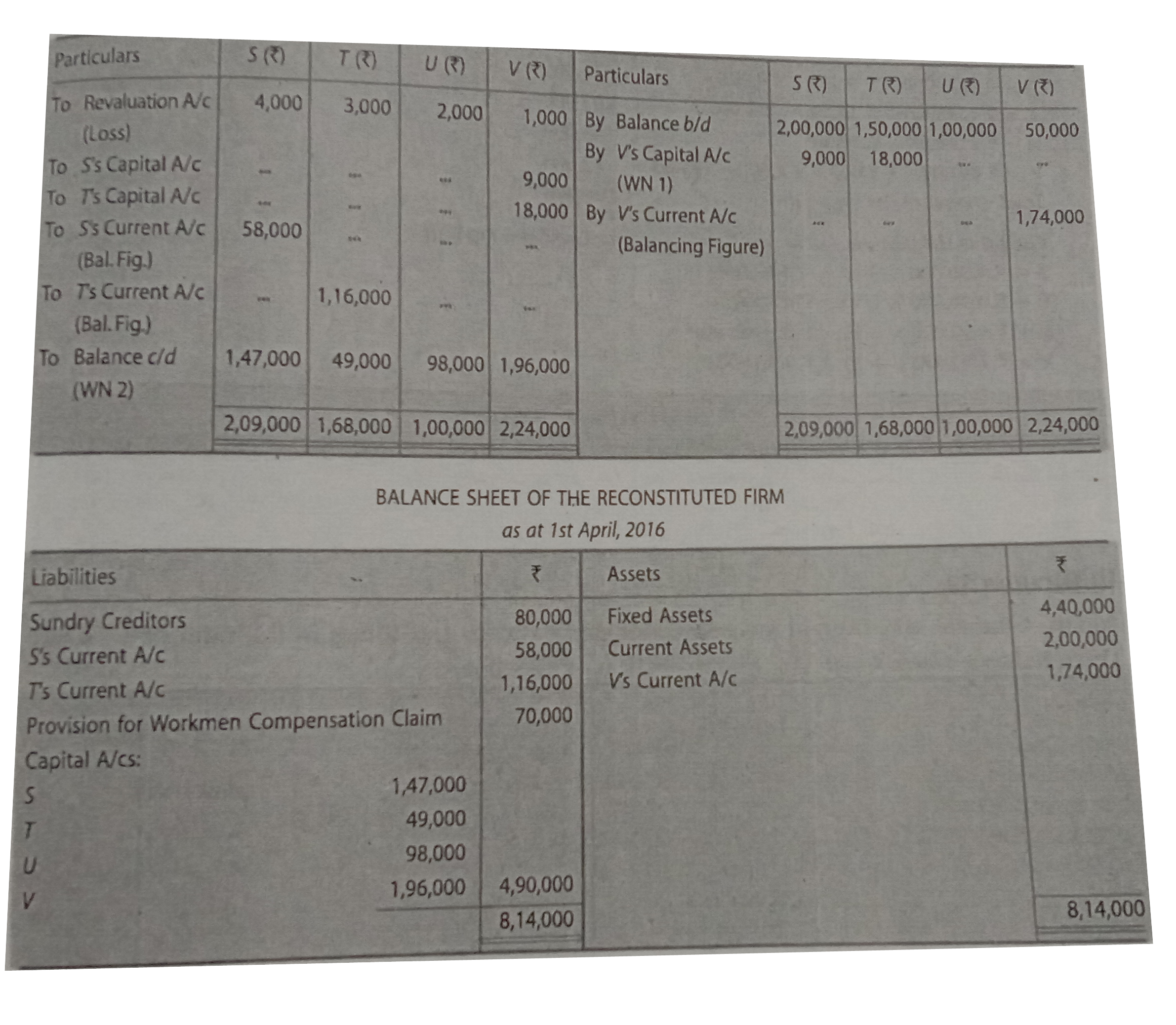

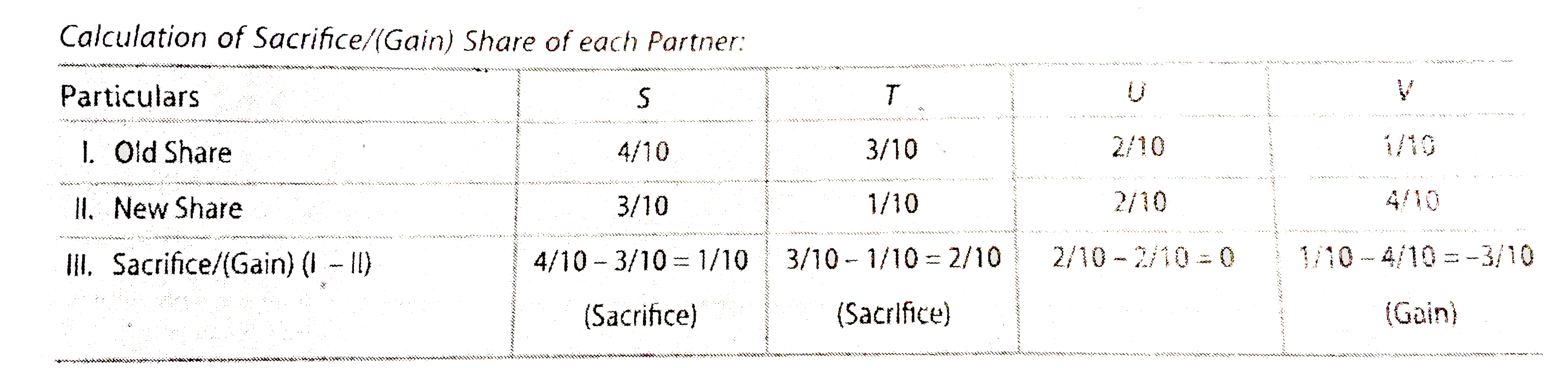

Answer» SOLUTION :  Working Notes: 1. Adjustment of Goodwill: Value of Firm's Goodwill = RS. 90000. CALCULATION of SACRIFICE/(Gain) share of each partner:  Journal Entryfor Adjustment of Goodwill `{:(,"To S's Capital A/c (₹ 90,000"xx"1/10)",,"9,000"),(,"To T's Capital A/c (₹ 90,000"xx"2/10)",,"18,000"):}` 2. Total Capital of the new Firmafter Adjustemet: `{:(,,"₹"),(,"S= ₹ 2,00,000+₹ 9,000- ₹ 4,000",="2,05,000"),(,"T= ₹1,50,000+ ₹18,000 -₹3,000", = "1,65,000"),(,"U = ₹1,00,000- ₹ 2,000" , = " 98,000"),(,"V = ₹50,000 - ₹1,000- ₹9,000 - 18,000" ,= " 22,000"),(,"Total Capital of the new Firm ", overlineunderlineunderline("4,90,000")):}` Capital of thepartners in the new frimas PER New Profit-Sharing Ratio: S = `₹ 4,90,000 xx 3//10 = ₹ 1,47,000`, `T= ₹ 4,90,000 xx 1//10 = ₹ 49,000`, `U = ₹4,90,000 xx 2//10 = ₹98,000`, and ` V = ₹ 4,90,000 xx 4//10= ₹1,96,000`. |

|

Discussion

No Comment Found

Related InterviewSolutions

- ZX Limited invited applications for issuing 5,00,000 Equity shares of Rs. 10 each at a premium of Rs. 10 each payable with Final call. Amount per share was payable as follows : {:(,"Rs."),("On Application",2),("On Allotment",3),("On First Call",2),("On Second and Final Call","Balance"):} Applications for 8,00,000 shares were received. Applications for 50,000 shares where rejected and the application money was refunded. Allotment was made to the remaining applicants as follows : {:("Category","Number of Shares Applied","Number of Shares Allotted"),("I","2,00,000","1,50,000"),("II","5,50,000","3,50,000"):} Excess application money received with applications was adjusted towards sums due on allotment. Balance, if any was adjusted towards future calls. Govind, a shareholder belonging to category I, to who 1,500 shares were allotted paid his entire share money with allotment. Manohar belonging to category II who had applied for 11,000 shares failed to pay 'Second & Final Call money'. Manohar's shares were forfeited after the final call. The forfeited sharses were reissued at Rs. 10 per share as fully paid up. Assuming that the company maintains ''Calls in Advance Account'' and ''Calls in Arrears Account'', pass necessary entries for the above transactions in the books of ZX Limited.

- ZLtd. forfeited 1,000 equity shares of Rs. 100 each for the non-payment of first call of Rs. 20 per share and ssecond and final call of Rs. 25 per share. State : (i) Can these shares be re-issued ? (ii) If yes, state the minimum amount at which these shares can be re-issued. (iii) If these shares were re-issued at Rs. 50 per share fully paid up, what will be the amount of Capital Reserve ?

- Zee Ltd. intends to issue 10,00,000 Equity Shares of Rs. 10 each to public for subscription. The management was suggested by the accountant Rahul that shares should be issued at 10% discount so that shares are subscribed in full. The management did not accept the suggestion of Rahul. What must be the reasonfor not accepting the suggestion?

- Zee Limited was registered with a capital of Rs. 20,00,000. divided into 80,000 shares of Rs. 25 each. The Company offered to the public for subscription 40,000 shares payable Rs. 7.50 per share on Application, Rs. 7.50 per share on allotment and the balance in two calls of equal amounts. The company received applications for 46,400 shares. Applications for 4,00 shares were rejected altogether and the application money was returned to the applicants. A person who applied for 4,000 shares wasallotted only 1,600 shares and the excess of his application money was carried forward rowards the payment to allotment and calls. Make Journal entries to record the above issue of shares.

- Zavier, Yusuf and Zaman were partners in a firmsharing profits in the ratio of 4:3:2. On 1st April, 2014, their Balance Sheet was as folows: Yusuf had been suffering from ill health and thus gave notice of retirement from the firm. An agreement was, therefore, entered into as on 1st April, 2014, the terms of which were as follows, (i) That land and building be appreciated by 10% (ii) The provision for bad debts is no longer necessary. (iii) That stock be appreciated by 20% (iv) That goodwill of the firm be fixed at Rs 54,000. Yusuf's share fo the same be adjusted into Xavier's and Zaman's Capital Accounts, who are going to share future profits in the ratio 2:1. (v) The entire capital of the newly constituted firm be readjusted by bringing in or paying necessary cash so that the future capital of Xavire and Zaman will be in their profit sharing ratio. Prepare Revaluation Account and Partners' Capital Accounts.

- Z Ltd. purchased machinery from K Ltd. Z Ltd. paid K Ltd. as follows: (i) By issuing 5,000 equity shares of Rs. 10 each at a premium of30%. (ii) By issuing 1,000, 8% Debentures of Rs. 100 each at a discount of 10%. (iii) Balance by giving a promissory note of Rs. 48,000 payable after two months. Pass necessary Journal entries for thepurchase of machinery and payment to K Ltd. in thebooks of Z Ltd.

- Zero Coupon Bonds are issued :

- Z is admitted to a firm for 1/4th share in the profits for which be brings in RS.10,000 towards premium for goodwill. It will be taken by the old partners in

- Z Ltd. Has a Current Ratio of 3.5 : 1 and Quick Ratio of 1.5 : 1. If the excess of current assets over quick assets as represented by stock is Rs. 60,000, calculate current assets and current liabilities.

- Young India Ltd. Hasa Operating Profit Ratio of 20% . Tomaintain this ratio at 25% management may